National Scale e-KYC Platform

Demystifying The Future!

Standardization and Compliance of KYC (Know you Customer) processes and data is a global challenge faced by commercial institutions and regulators alike. Consonance is a state of the art EKYC platform that regulates and harmonizes national EKYC standards and data across all financial institutions within a jurisdiction.

Consonance is ideally championed by regulator(s), state-owned entities and/or banking federations in a utility model.

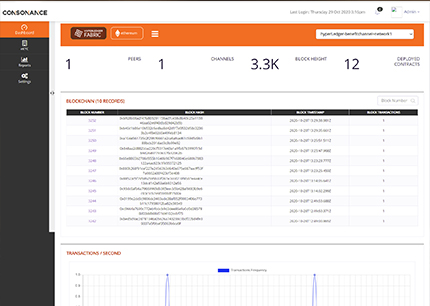

Powered by blockchain – Consonance is a national vehicle to ensure global and national KYC standards and compliances are accurately followed and adhered-to by the participating entities and commercial enterprises.

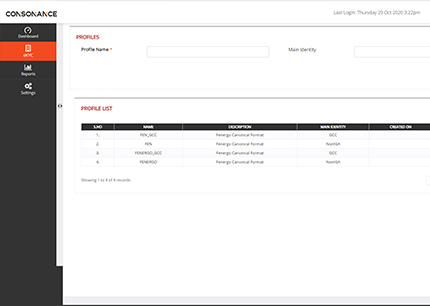

While on one hand Consonance provides a national view of KYC data and compliance to the regulator(s), on the other hand participating commercial entities’ customer on-boarding and KYC costs are drastically reduced, while ensuring regulatory compliance. A comprehensive and secure Customer Consent engine built within Consonance is used to trigger customer data sharing between participating entities.

Consonance rule engine smartly and proactively detects Customer KYC Data anomalies (if any) and relays exact mismatches to relevant commercial entities where the customer bears a relationship. Consonance ensures KYC data standardization and harmonization across institutions for both individuals and corporate entities.

Customer KYC data versions and changes are maintained on the blockchain layer for complete auditability and transparency and for all relevant entities to tap and review.

Further, platform provides the capabilities to evolve as a generalized platform for not just KYC but a document exchange network for banks and other sectors in future with power of blockchain platform as base solution.